Pavliga Introduces Priority Bill for a State Tax Credit for Workforce and Resident Housing

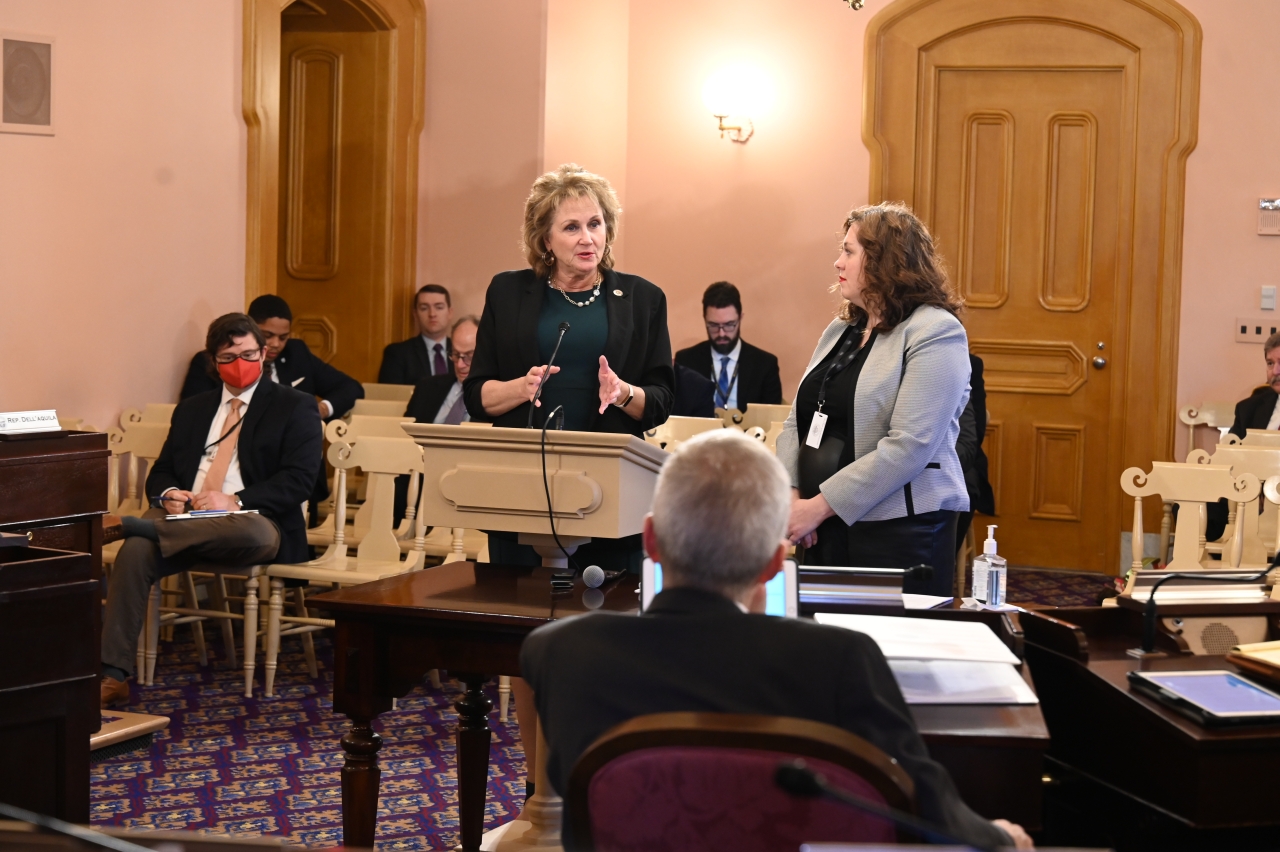

State Rep. Gail Pavliga (R-Portage County) has introduced House Bill 3, which authorizes a tax credit for certain housing to address the needs of the state’s workforce, veterans, and seniors across the state. Pavliga testified on the legislation during its first committee hearing on Tuesday.

“House Bill 3 will meet a critical need to address our growing workforce housing crisis,” said Pavliga. “This proposal leverages more federal funds, increases the attractiveness to invest in Ohio, creates thousands of jobs, generates meaningful economic impact and tax revenue, and creates more affordable housing for our citizens.”

Pavliga notes that twenty states have enacted a state housing tax credit to provide state-level funding to draw down federal housing credit resources to meet workforce and affordable housing needs. As a result, those states receive more investment and development.

House Bill 3 seeks to make Ohio more competitive to incentivize more housing development by authorizing the state tax credit. Additionally, the legislation is performance-based. Developers may choose not to utilize this incentive program, if so, no tax credits will be claimed. Further, if developers awarded credits do not make good on their commitment, then the state has the ability to reverse the award.

During her testimony, Pavliga pointed out that in 2020, only three of the 10 most common jobs in Ohio paid an hourly rate necessary for a worker to afford a modest, two-bedroom apartment.

“This causes a significant rent burden not only among Ohio’s lowest income but also moderate-income renters across the state,” Pavliga added. “Due to the shortage of affordable housing, nearly 400,000 households in Ohio face a severe cost burden, spending over half their income on rent.”

A way the bill works to fix this issue is by incentivizing private sector investments and pair them with resources of the existing successful program through LIHTC.

Pavliga introduced this legislation during the previous General Assembly and is looking to advance this initiative through the Statehouse as a House priority bill.

The representative’s testimony in the House Economic and Workforce Development Committee can be viewed here.