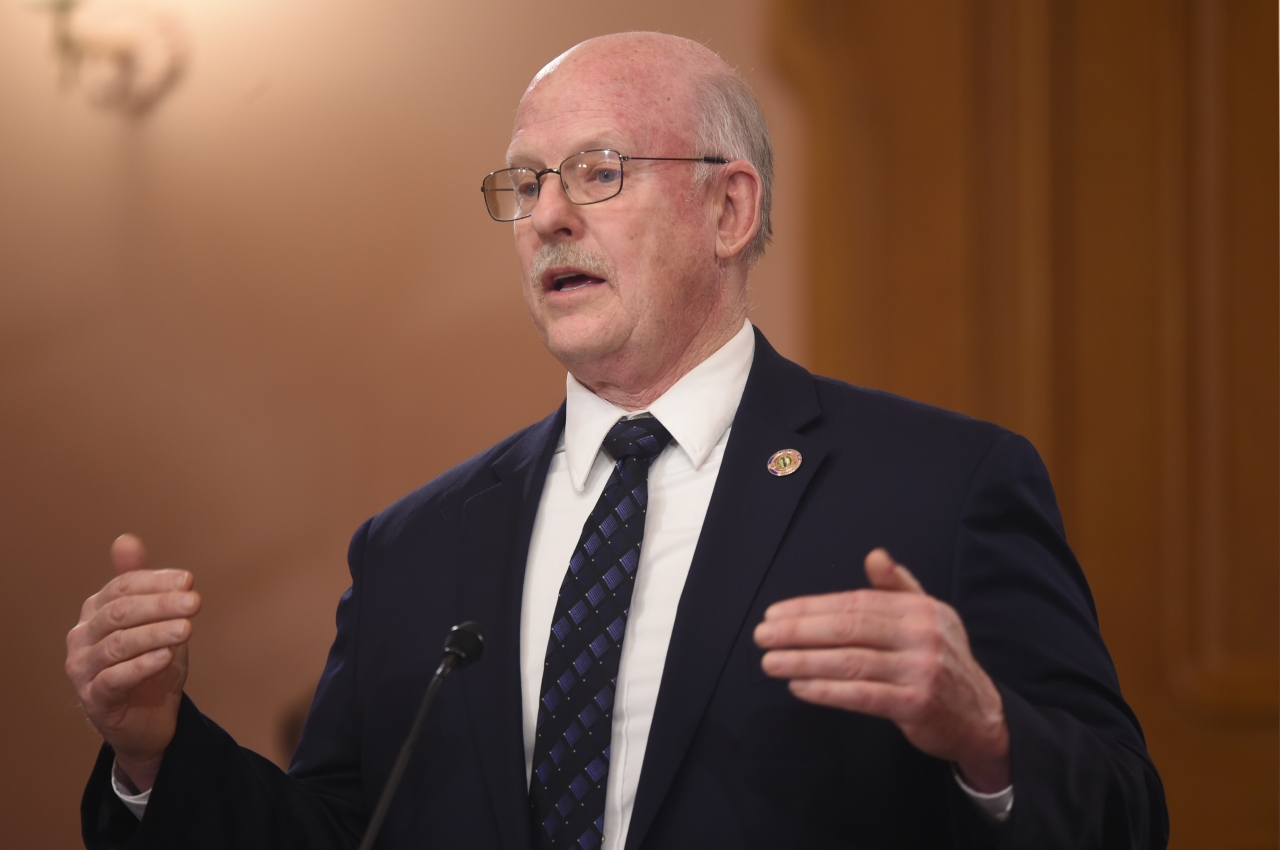

Roemer Advocating for Municipal Income Tax Penalty Caps

COLUMBUS – State Representatives Bill Roemer (R-Richfield) and Laura Lanese (R-Grove City) today offered sponsor testimony in the Ohio House Ways and Means Committee on House Bill 519, which places limits on late filing penalties for municipal income taxes.

As current law is written, a taxpayer may be charged late filing fees that exceed the actual amount owed, namely if one’s tax liability is relatively small. In some cases, a taxpayer could be charged up to $150 in fees even if they owe no tax.

“Ohio taxpayers deserve to be treated fairly and with respect,” said Roemer. “This legislation will ensure that Ohio taxpayers aren’t faced with the burden of excessive or arbitrary penalties, and that no taxpayer with zero liability will be punished for failure to file.”

Under the bill, late filing penalties would be limited to the lesser of 50% of the taxpayer’s liability or $150, ensuring that taxpayers with low tax liabilities are not unfairly punished.

Additionally under the bill, tax administrators would be prohibited from sending inquiries or notices to taxpayers who have received a filing or payment extension before the extended due date. Furthermore, if this prohibition is violated, tax administrators would be required to reimburse the taxpayer for any costs incurred to respond to that inquiry.