Democratic News

Featured Stories

News Feed

State Rep. John Boccieri today wrote to the Ohio Environmental Protection Agency (OEPA) regarding outstanding concerns over when the agency claims it first learned of test results revealing water contamination in Sebring, Ohio. Boccieri's office recently received documentation from the state's water testing vendor, Ream and Haagar Environmental Lab, that confirms the vendor first notified the Ohio EPA in August of test results showing elevated lead levels in Sebring's water.

State Rep. John Boccieri (D-Poland) today announced legislation to establish clear standards for water testing and public notification procedures in cases of lead contamination. The legislation comes in the midst of the Sebring water crisis, in which records have revealed that the Ohio Environmental Protection Agency (EPA) failed to notify residents of Sebring, Ohio that area water had higher-than-normal levels of lead for almost five months.

Marking the seventh anniversary of the federal Ledbetter Fair Pay Act, Ohio House Democratic Women Democratic (OHDWC) lawmakers today highlighted efforts underway in the legislature that would level the economic playing field for women in Ohio, including “Equal Pay for Equal Work” legislation.

“A lot has changed for families, women and workplaces since the 1950s. It is time to stop treating women only as homemakers and recognize the fundamental leadership roles we hold in the corporations, public service and the family unit,” said OHDWC Chair and State Rep. Fedor (D-Toledo). “Equal pay for equal work is a keystone of our American values of freedom and fairness. It is time for our state to take the lead and show women, families and the nation that equal pay can’t wait.”

State Rep. John Boccieri (D-Poland) today called on the Ohio House of Representatives to subpoena Ohio EPA Director Craig Butler to answer questions relating to the state’s failure to protect the public for some six months after toxic drinking water was found in Sebring and Beloit, Ohio.

The lawmaker has repeatedly called on the director of the Ohio EPA to provide the public with answers to basic questions surrounding the renewal of water permits and sluggish communication that forced seniors, pregnant mothers and children to unknowingly drink water contaminated with copper and lead.

“We have received no answer to our repeated questions about steps taken by the EPA, which shares a moral and legal obligation to notify the public when such a crisis evolves, to remedy this crisis.” Boccieri wrote in the letter to Speaker of the House Cliff Rosenberger.

EPA Director Butler is Gov. John Kasich’s former policy advisor and was appointed by Gov. Kasich to the Ohio EPA after the former director resigned amid questions of improper political pressure on state water regulators.

A copy of the letter is attached with text available below:

State Rep. John Patterson (D-Jefferson) this week introduced House Bill 438, legislation to designate the week before Thanksgiving as “Ohio Public Education Appreciation Week.” Proposed as an occasion to celebrate public education and honor individuals that make a difference in ensuring every child receives a quality education, the annual period of recognition will coincide with the national American Education Week, which was initiated by the National Education Association in 1921.

“A child’s education is an invaluable asset that they carry with them for their entire life. Now, more than ever, it is important to show our strong support for public education,” said Patterson, who is a retired public school teacher and coach. “Educators across our state are dealing with budget cuts and unprecedented scrutiny at the local and state level. We should use this opportunity to affirm our support of Ohio’s dedicated public educators and recognize the important role they have in our communities.”

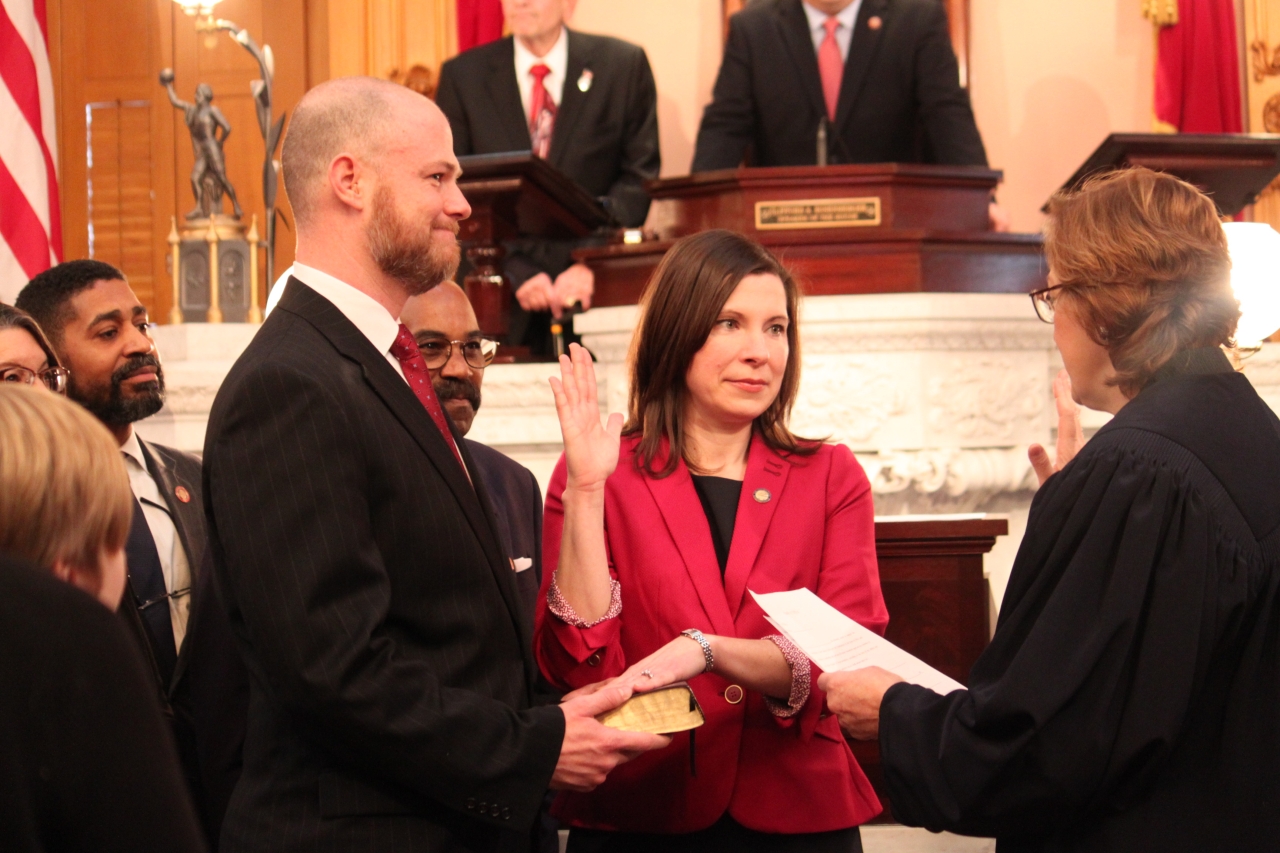

The Ohio House Democratic Caucus today swore in former assistant attorney general Kristin Boggs as state representative for the 18th House District. Boggs – the daughter of former State Senate Minority Leader and Ohio Department of Agriculture Director Bob Boggs – will take over the seat most recently held by former Rep. Michael Stinziano, who left at the end of 2015 to serve on Columbus City Council.

“I am looking forward to going to work for the people of the 18th House District, it will be an honor to serve the community. There are many important issues being debated at the statehouse, and I will strive to advance policies that keep central Ohio growing in the direction that our residents expect and deserve,” Boggs said. “Columbus enjoys a world class university system, a growing economy and thriving cultural community— I will work hard to make sure that all individuals and families have opportunity, equality, and success.”

Reps. Michael Sheehy (D-Oregon) and John Patterson (D-Jefferson) introduced legislation this week to establish the “Annie Glenn Communication Disorders Awareness Day” in honor of Mrs. Annie Glenn and to recognize all Ohioans who have struggled with a communication disorder. The legislation designates February 17, Annie Glenn’s birthday, as the official day of recognition.

State Rep. Teresa Fedor (D-Toledo) hosted the Seventh Annual Human Trafficking Awareness Day today at the Ohio Statehouse, as lawmakers, law enforcement officials, advocates and survivors from across the state and nation gathered for a day of discussion on ways to raise awareness and fight back against human trafficking in Ohio. Fedor also outlined the next legislative steps in fighting modern-day slavery through reforming Ohio’s DNA collection methods, something she has proposed through House Bill 283.

Lorain City Schools officials and local lawmakers today announced plans calling for community stakeholders to participate in open dialogue sessions to develop a plan to improve educational achievement for students and take proactive measures to avoid further state control.

“Community-based solutions that put our children’s future first can’t only come from Columbus,” said Representative Dan Ramos (D-Lorain). “That is why it is so important that local leaders, lawmakers, educators, parents and students come together to put forward a plan that works by giving all of our children an equal opportunity to earn an education that puts them on a trajectory toward success.”

State Representative Teresa Fedor (D-Toledo) will host the seventh annual Human Trafficking Awareness Day on Thursday, January 14 at the Ohio Statehouse Atrium from 8:30 a.m. to 3:30 p.m. The annual event features a resource fair and educational panels of advocacy professionals and human trafficking survivors.*

“The work we have done in Ohio to combat human trafficking has put criminals behind bars, raised public awareness and given victims hope,” said Fedor. “When we started this fight ten years ago, the odds seemed long. Laws prohibiting and defining human trafficking in Ohio didn’t even exist, and few understood - let alone recognized - the underground network of evil that ripped apart families and communities. I am pleased with our progress over the last decade and with our efforts to educate and mobilize lawmakers, law enforcement and the general public to develop comprehensive solutions that put an end to modern-day slavery.”

- Page 1

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Page 81

- Page 82

- Page 83

- Page 84

- Page 85

- Page 86

- Page 87

- Page 88

- Page 89

- Page 90

- Page 91

- Page 92

- Page 93

- Page 94

- Page 95

- Page 96

- Page 97

- Page 98

- Page 99

- Page 100

- Page 101

- Page 102

- Page 103

- Page 104

- Page 105

- Page 106

- Page 107

- Page 108

- Page 109

- Page 110

- Page 111

- Page 112

- Page 113

- Page 114

- Page 115

- Page 116

- Page 117

- Page 118

- Page 119

- Page 120

- Page 121

- Page 122

- Page 123

- Page 124

- Page 125

- Page 126

- Page 127

- Page 128

- Page 129

- Page 130

- Page 131

- Page 132

- Page 133

- Page 134

- Page 135

- Page 136

- Page 137

- Page 138

- Page 139

- Page 140

- Page 141

- Page 142

- Page 143

- Page 144

- Page 145

- Page 146

- Page 147

- Page 148

- Page 149

- Page 150

- Page 151

- Page 152

- Page 153

- Page 154

- Page 155

- Page 156

- Page 157

- Page 158

- Page 159

- Page 160

- Page 161

- Page 162

- Page 163

- Page 164

- Page 165

- Page 166

- Page 167

- Page 168

- Page 169

- Page 170

- Page 171

- Page 172

- Page 173

- Page 174

- Page 175

- Page 176

- Page 177

- Page 178

- Page 179

- Page 180

- Page 181

- Page 182

- Page 183

- Page 184

- Page 185

- Page 186

- Page 187

- Page 188

- Page 189

- Page 190

- Page 191

- Page 192

- Page 193

- Page 194

- Page 195

- Page 196

- Page 197

- Page 198

- Page 199

- Page 200

- Page 201

- Page 202

- Page 203

- Page 204