Democratic News

Featured Stories

News Feed

Ohio House Democratic lawmakers today sent a letter to Governor Kasich urging him to line-item veto the Medicaid expansion freeze in the state operating budget, House Bill (HB) 49, that will end healthcare coverage for over half-a-million people.

“The people of Ohio deserve representatives in Columbus who will stand up and fight for them,” said state Rep. Emilia Strong Sykes (D-Akron). “Passing the Medicaid expansion freeze and kicking people off of Medicaid is unacceptable, harmful, and cruel and unusual punishment.”

If approved by the federal government, the GOP freeze to Ohio’s Medicaid expansion will phase out medical coverage for over half-a-million Ohioans, leaving families with minimal healthcare options.

“We need to provide healthcare for Ohio’s families, all of Ohio’s families.” Sykes said. “Without access to healthcare, lives will be lost and costs will rise. Ohio cannot afford to pay for the increased costs that will come by taking away people’s healthcare.”

*Editor’s note: A copy of the letter sent to Gov. Kasich is pasted below.

The Ohio House voted today on the Republican-led charge to restrict worker’s access to healthcare and benefits through the state’s $581 million Bureau of Workers’ Compensation (BWC) budget bill, House Bill 27.

GOP lawmakers undertook a significant rewrite of what is typically a noncontroversial budget bill to include benefit restrictions on firefighters with cancer. The $581 million measure also cuts in half the amount of time all workers currently have to file a claim, something Democrats say could economically destabilizes thousands of Ohio families.

“The brave men and women who run into burning buildings while everyone else runs away deserve better than new barriers to care when they are seriously injured or get sick on the job,” said House Minority Leader Fred Strahorn (D-Dayton). “Retreating from firefighters who contract cancer from their dangerous line of work and closing the door early on workers seeking treatment for workplace injuries seriously undermines the economic stability of working families across the state.”

COLUMBUS— Amid a more than $1 billion financial shortfall, Ohio’s legislative Republicans pushed state budget negotiations closer to the brink Tuesday and today with eleventh hour horse-trading over a Medicaid lockout and complex money maneuvers, leaving Gov. John Kasich less than 48 hours to review the state budget, House Bill 49, before the start of the new fiscal year.

“This budget not only threatens the economic well-being of working families, but attacks the health of hundreds of thousands of vulnerable Ohioans,” said Rep. Alicia Reece (D-Cincinnati). “At a time when Ohio leads the nation in opioid deaths, too many babies are dying before their first birthday in our state, and many families have love ones fighting some type of cancer or other serious health condition, blocking access to Medicaid for those who need it most literally puts the lives of Ohioans on the line.”

Amid a more than $1 billion financial shortfall, Ohio’s legislative Republicans pushed state budget negotiations closer to the brink Tuesday and today with eleventh hour horse-trading over a Medicaid lockout and complex money maneuvers, leaving Gov. John Kasich less than 48 hours to review the state budget, House Bill 49, before the start of the new fiscal year.

“While the rest of America is recovering from the global recession, six years of Republican mismanagement have held us back from solving real problems like attracting better-paying jobs, reducing healthcare costs, and strengthening our children’s schools,” said House Democratic Leader Fred Strahorn (D-Dayton). “Our economy continues to underperform and people at home are feeling it. The state is on a downward spiral to recession.”

Before state lawmakers head into conference committee to hammer out the final details of the state biennial budget, House Democratic leaders today questioned whether the legislation adequately addresses the state’s current fiscal crisis that has left Ohio families struggling to make ends meet and communities underwater.

“The Ohio GOP’s misguided tax policy has not created the economic stability, better-paying jobs or real growth that was promised. While the rest of the nation is recovering from the Great Recession, Ohio has been held back,” said House Democratic Leader Fred Strahorn (D-Dayton). “After six years of being wrong – wrong about a tax policy that favors the wealthy over the middle class, wrong about state revenue numbers for 10 out of 11 months, wrong even about how much needs to be cut to balance the budget – I have no doubt that the same failed approach based on ideology instead of facts will only do more harm to working Ohio families and send our economy deeper into a tailspin.”

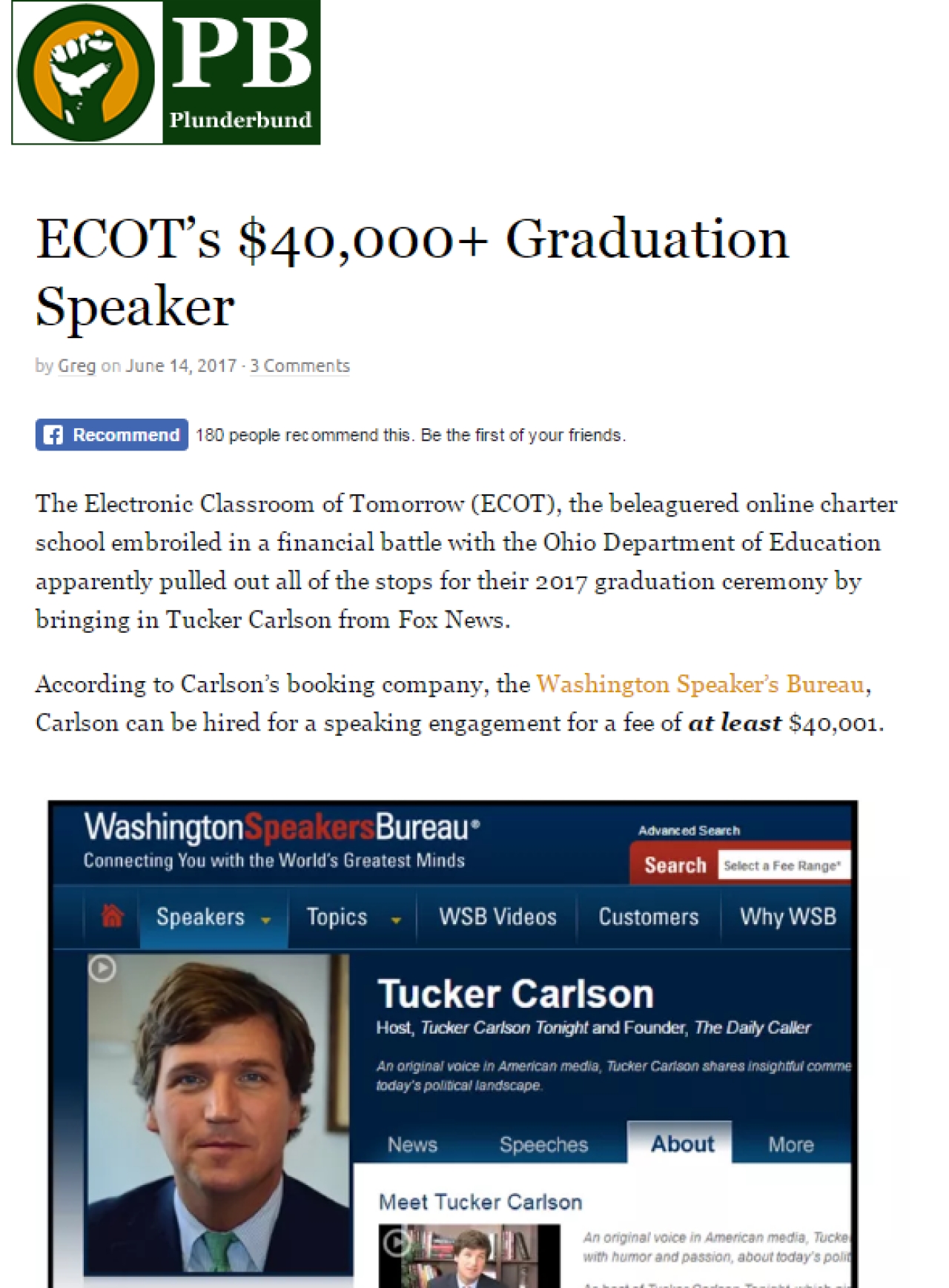

State Rep. David Leland (D-Columbus) will offer testimony during Education and Career Readiness Committee TODAY, Tuesday, June 20 at 3:00 p.m. in the Statehouse on House Bill (HB) 220, legislation to shine a light on how charter schools spend taxpayer dollars. The Columbus lawmaker’s testimony follows the Columbus Dispatch’s recent editorial reporting of nearly $200 million tax dollars that ECOT, the state’s largest online charter school, spent on management fees to companies owned by its founder.

“Just as Ohio parents want to know that their children are receiving the highest quality possible education in school, Ohio taxpayers deserve to know how their hard-earned dollars are being used,” said Leland. “Our Constitutional mandate to create a “thorough” and “efficient” public school system demands nothing less.”

WHO: State Rep. David Leland (D-Columbus)

WHAT: Education and Career Readiness Committee

Sponsor testimony for HB 220

WHEN: TODAY, Tuesday, June 20 at 3:00 p.m.

WHERE: Ohio Statehouse, Room 121

As Statehouse Republicans struggle to cut $800 million to balance Ohio’s next two-year budget, preliminary revenue estimates for this May show the state faces greater fiscal uncertainty than initially anticipated. Lawmakers will now have to contend with an additional $67 million less in spending for the current fiscal year. House Democratic Leader Fred Strahorn (D-Dayton) and the lead Democrat on the House’s state budget panel, Rep. Jack Cera (D-Bellaire), issued the following joint statement in response:

“The TV weatherman is right more than Ohio Republicans have been about Ohio’s financial future. Meanwhile, with every month that passes, taxpayers have a front row seat to see how years of deep cuts to schools and communities, tax shifting and tax giveaways for millionaires and billionaires are pushing our economy further out of balance and charting a collision course of uncertainty and failure.”

Often in our day-to-day lives, we may forget the sacrifices made by our greatest public servants – the brave and selfless men and women in the Armed Services.

We owe them a tremendous debt. The freedoms we enjoy are not free, and the price tag is often grim. We know that we can never repay that debt. We can only acknowledge it, and say, “thank you.”

The celebration of Memorial Day reminds us of this debt we owe to our veterans and current military members, whose selflessness, sacrifice and courage helps keep our nation safe.

State Rep. and Ohio Democratic Women’s Caucus Chair Teresa Fedor (D-Toledo), State Rep. and Vice Chair Michele Lepore-Hagan (D-Youngstown) and members of the House Democratic Women’s Caucus today gathered with about 200 women representing nearly 30 counties from across the state to discuss and lobby for policy solutions to challenges Ohio women and families face.

“Women’s active participation in the political process is vital to ensure equal representation, especially after men dominated the polls up and down the ballot during the last election,” said OHDWC Chair Teresa Fedor. “When women in Ohio don’t have the same level of access to opportunity and prosperity, our entire state pays the price. By empowering women to engage with their elected officials and advocate for policies that advance gender equality in our state, we can help boost the quality of life for all Ohio families.”

State Rep. Teresa Fedor (D-Toledo) today issued the following statement in response to a state ruling against ECOT, the state’s biggest, failing online charter school, for what amounts to embezzling some $60 million in taxpayer dollars by falsely inflating student attendance:

“ECOT and other charter schools have been fleecing taxpayers for years while GOP lawmakers turned a blind eye speaking at graduation ceremonies and building their campaign coffers on the broken promises to families, taxpayers – and most importantly – our children.

“With sixty-million dollars essentially being stolen from taxpayers, today’s ruling draws into question the massive amounts of cash GOP lawmakers have accepted from ECOT over the years. I am calling on GOP lawmakers to tally up and return all ECOT campaign donations in a check written to the state from their campaign.

“If we refuse to fully hold Ohio’s failed charter school experiment accountable through tougher laws and standards, lawmakers should at minimum hold themselves accountable for being complicit in the theft of tax dollars from our taxpayers. That starts with doing the right thing, and returning campaign donations to the state.”